Welcome to the Weekend Reccs. Today’s world is curious and cacophonous. This newsletter delivers an eclectic sample of some things to read, watch, and ponder over your weekend. There’s a lot of economics and politics, but there is also so much more.

New here? Be sure to subscribe to never miss an issue and please share a post with your friends. The links marked with asterisks (*) are the recommended reads.

Hi friends,

As of last evening, we have an approved COVID-19 vaccine. That is very exciting, and underlines the importance of this week’s Vaccinating Against Bad Economics.

Last week’s issue discussed why why you shouldn’t trust the unemployment rate. If you missed it, you can read it here. As always, you can skip this section if you’re just looking for this week’s links.

The Long Read: VABE 2, “Inflation is spiking! Time to raise rates!”

Like last week’s bad take, this one is tricky because there will be real data that appears to support the bad take. That’s why it is so important that we discuss it up front, today, before it can take hold. You’ll almost certainly hear this take in the first half of 2021.

A quick primer on inflation

Inflation (when prices go up) can be tricky to wrap your head around, and not just because it requires realizing that the only thing propping up the entire global economy is that we all trust that tomorrow will look a lot like today. But inflation really boils down to one big thing: too many dollars chasing too little output.

If you took an introductory economics class you probably heard about three, or four, or five causes of inflation. I would argue that you can get away with literally just this one — the others are just different ways of describing why there are too many dollars or too little output.

Inflation is managed by the Federal Reserve (the Fed). The Fed actually has two jobs: keep inflation at reasonably low levels and run the economy at the highest sustainable level of employment. Because things like inaccurate theories about the macroeconomy, oil crises, financial system meltdowns, and global pandemics get in their way (and because multitasking is inherently difficult), they’ve never really fulfilled these two roles simultaneously for any noticeable amount of time. But that’s another story for another time.

How does the Fed try to fulfill these two jobs? Primarily by changing the federal funds rate, which affects interest rates. For today, what we need to know is that interest rates have downstream consequences on how many people get employed and how much inflation the economy experiences, and that interest rates and inflation generally move in opposite directions (higher interest rates = lower inflation).

Inflation and you

You very well may be wondering why you should care about inflation at all, and, directly, you probably don’t need to. America has undergone a period of mild inflation (2-3%) for the last 35 years. That seems unlikely to change soon. The Fed has been very vigilant about managing inflation, and you probably can expect it to be mild for the foreseeable future.

I would argue then that really you should care about inflation indirectly, first because it influences the Fed’s behavior (which you should care about) and second because other people will care a lot about inflation and have bad takes and I want you to know enough to know not to care about their bad takes.

The Vax Bump

Back to the bad take. Imagine for a second it is early 2021, a lot of folks have gotten vaccinated, and people in the takes-osphere are saying that inflation is rising because we’ve been “printing too much money” and that the Fed needs to aggressively raise rates to stop it. You should not listen to these people.

Here’s what will actually be happening.

After folks get vaccinated they’re going to go on a spending spree. I mean, don’t you want to go on a spending spree? Vacations, eating inside restaurants, bars, museums, concerts, dental appointments…you name it, I know I want to be there. I’ve got all this pent up demand for things I have been waiting to do and I can’t wait to go spend my (small amounts of) money.

I’d posit basically everyone feels this way.

So we’re going to have a period with a lot more demand for goods and services as people, effectively, blow off steam. This big influx of dollars is going to be chasing a pretty set number of indoor restaurant tables and airplanes and J. Coles. In response, firms will raise their prices (probably more so with things like planes and concert tickets than restaurant menus) and we’ll get inflation.

That’s most of the mechanism at play here.

Astute readers may note that while they may, today, on December 12th, 2020, feel like they want to get black-out drunk at a packed club every night of 2021 post-vaccination, they probably won’t do that. They’ll blow off some steam and then retreat back in to the normal throes of life after a few weeks or months (depending on how fun the club is).

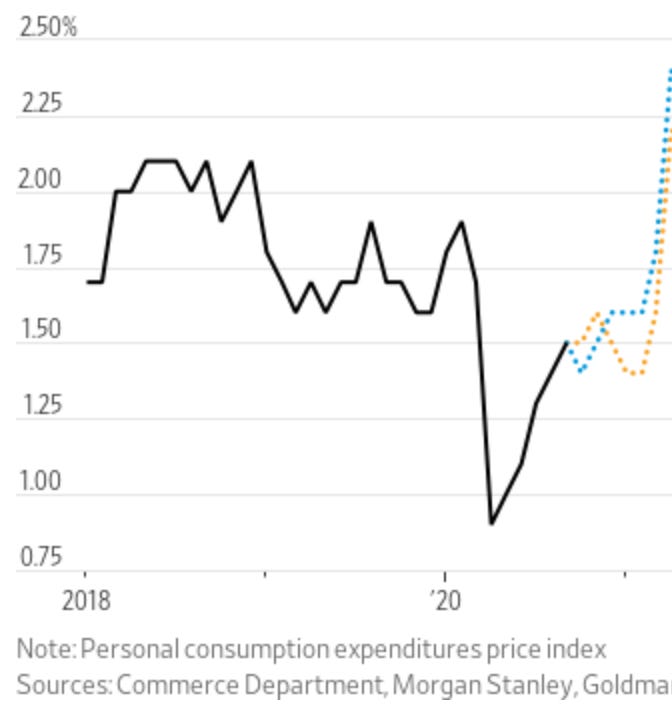

And that’s basically what we see in this graph of inflation expectations:

Now, you should be skeptical of all forecasts, sure, but this graph is a useful illustration for the central point. We’ll see a spike and then a dip.

We definitely should not expect a spike after people get vaccinate that then just runs off the top of the chart and destroys the American economy.

That first half of 2021 will be scary for folks that will peddle this week’s bad take. You’ll see them use lots of graphs like this:

But you should remember this is temporary and what the other half of this chart is going to look like.

We’ll be fine within a year.

We do not need to raise rates.

Why don’t we just raise rates to be safe?

So, you may be wondering why we don’t just raise rates to be safe. This gets back to the whole you-should-care-about-inflation-because-you-should-care-about-what-the-Fed-does part. When the Fed raises rates, it slows down the economy. That means people who may have otherwise secured a job remain unemployed our out of the labor force. Disproportionately these are low-income workers and those with low educational attainment. It doesn’t just hurt the American economy as a whole when we raise rates to quickly — it acutely hurts the least advantaged members while also hurting the rest of us, too.

The good news is that the Fed almost certainly won’t raise rates next year no matter how many times people try to convince you that we need to raise rates.

Will we get high long-term inflation from Congress spending so much money?

No.

Going back to the beginning: too many dollars chasing too little output. Government spending during a recession boosts output by bringing more people into the economy. One way to think about it is by asking how much slack there is in the economy. There are a lot of people who are unemployed or out of the labor force. So Congress’s spending is increasing the dollars in the economy while also increasing the output. Maybe there’s some inflation attributable from it, but it won’t be the doomsday prophecies you’ve likely heard.

What if we don’t get a surge in inflation in early 2021?

Primarily I would look silly for spending so much time writing this, but honestly this seems really unlikely.

We actually might find this outcome more worrisome, as it would suggest that people are not getting back out and spending. So let’s hope we’ll get a pop in inflation as folks get back out and blow off some steam, and let’s not raise rates because that bump will be harmless.

The Quick Links

Herding Cats* Youyang Gu, a data scientist who produced one of the best COVID-19 models this spring and summer, estimates July 14, 2021 as the day the US reaches herd immunity. Disclaimers: 7 months away is a long time, he’s not an epidemiologist, etc., etc.

Buried Treasure* Lots of folks are digging in areas with a long histories for various reasons. For some gardeners, it is a pay day (s/o Marina Felix). More generally, though, it seems metal detecting is seeming to have a moment, being an easily socially-distant activity. Some folks even have started working as full-time metal detector streamers.

Busy Beavers* What really, really, really slow computer programs can tell us about the limits of mathematics

Mostly Harmless* A mystery from the nature preserve where I used to go on field trips in elementary and middle school. A hiker turns up dead, nobody knows how he died or who he is (still).

Lagniappe

In honor of Charley Pride, who died earlier today from complications related to COVID-19, this week’s lagniappe is a song of his that is one of my all-time favorites:

Graph(s) of the week

[Pew] Unpartnered mothers took the biggest hit in terms of employment outcomes.

[Me…?] Apologies if I stole this idea from someone, feels like it probably is not original, but (1) COVID-fads have some durability after they peak, (2) The Queen’s Gambit has been great for the game of chess.

[WSJ] Everyone knows city populations are getting shaken up. It looks like folks are headed, unsurprisingly, for where its warmer and cheaper.

[Urban Institute] Pretty tight correlation here between states that are hurting and those that only have sales taxes (no income tax). Notable exceptions being places you would go if you were fleeing California. Declining revenues are part of why we need state relief now.

Thanks for reading to the end. These last few weeks I’ve been trying out a few different schedules for when this email goes out each weekend. I’d love it if you’d send me a quick email with your preferred time on either Saturday or Sunday to receive it (if you don’t care let me know that, too) so I can send it when most of y’all want it!

Your friend,

Harrison