Hi everyone!

I hope you all had a great week…it was a busy one for me! But life is good for the living.

The Weekend Reccs

How do you sporgle a morgle? Last week when OpenAI's language model GPT3 was released it created quite a buzz. This AI could write code from text requests, and imitate fiction written by human authors, and answer questions about why bread is fluffy, and who knows what else? There were takes that it was the start of the end-times, that it was the biggest leap in the history of AI, etc. As one does in times of such uncertainty, I turned to the smartest friend I have on such matters. His take, paraphrased:

Imagine you are a fugitive on the lam and hide somewhere on the globe. The CIA tracks you down. Should we be surprised? Probably not. It's an impressive feat, but one that had an enormous amount of resources behind the hard work. Now, if we were to ask a private investigator with a chip on his shoulder and nothing to lose to track you down, and he did, we should be enormously impressed. The world is a big place and the PI didn't have nearly the same resources as the CIA does. GPT3 is the CIA. It works hard, and it's really cool, but it’s not necessarily earth-shattering because it is not very efficient. AI will have a quick pace forward, but it has a way to go, both to make it more efficient and smarter (GPT3's response to the nonsense question leading this section: “You sporgle a morgle by using a sporgle.” When my response would have been something like "Kevin, you're drunk, go home."). GPT3 is a step forward, but more a statement of OpenAI's enormous computing power than anything.

Finance does a thing: Baseball players and MBA students are basically forming co-ops.

“The Color of Money”: A very good interview on the racial wealth gap. Her response on colorblindness and COVID was one of the best ways of packaging a point that I feel many people stumble on trying to convey.

Me, Myself, and I: A debate is going on in the world of biology as to what counts as an individual. These free-energy principle people seem to have some good ideas.

The biggest news nobody is talking about: The creation of EU-backed bonds. This may prove to be the single most consequential defining point in the history of the EU as not only an economic, but also a political union. There is now a real, if small, path towards an integrated fiscal zone to complement the integrated monetary zone.

Something is fishy in the state of Denmark: How a Danish company is trying to turn south Florida into the salmon hub of America using 1.05 pounds of feed for every pound of salmon filet.

Econ Paper Roundup: A new paper suggests overprescription, and not economic stagnation, drove the opioid epidemic. In short, (1) non-Hispanic white Americans, who have lower rates of unemployment than, say, Black Americans, were the epicenter of the epidemic, and (2) the geographic spread of the epidemic does not align cleanly with economic stagnation, nor does it show a correlation with the business-cycle more broadly.

Lagniappe

This week I bought a laptop stand so that I can work without hunching over my computer. If you travel a lot or are WFH but don’t want to invest in (or, like me, don’t have room for) a monitor I highly recommend getting a laptop stand with a bluetooth keyboard and mouse. My back is already happier with me.

Graphs of the week

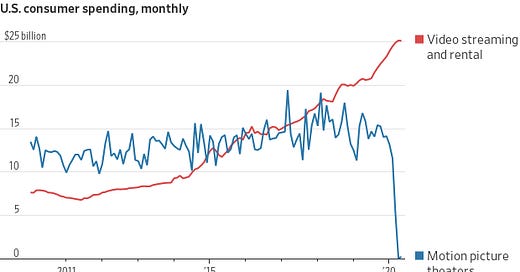

[WSJ] This chart reminds me of watching a knee replacement surgery. Like yeah, I know what happens, but, God, it is horrifying to look at.

[WSJ] I’m sure Kenneth Rogoff is not a happy camper. TL;DR on his book: people use cash for (1) tax evasion, (2) illicit activities, (3) protecting themselves from negative interest rates. We should work to build an inclusive digital economy such that we could get rid of all cash, but, if nothing else, we should at least get rid of the $100.

[WSJ] This chart is not what you should be worrying about. What you might reasonably worry about: net interest payments / tax receipts (see second chart below). You shouldn’t worry about that, though, because we’re still in a good place thanks to low low interest rates. Have a longer piece on this exact topic sitting unedited on my computer…really should get around to it…

See you all next week!

Your friend,

Harrison