November 15, 2020

100+ Subscribers, Meat without Animals, Choosing Well, Innovations in Real Estate

Welcome to the Weekend Reccs. Today’s world is curious and cacophonous. This newsletter delivers an eclectic sample of some of the best things to read, watch, and ponder over your weekend. There’s a lot of economics and politics, but there is also so much more.

If you were forwarded this from a friend be sure to subscribe to never miss an issue. If you aren’t sure this is for you, keep reading—you’ll have another opportunity at the end!

Hi friends,

Enjoy this week’s issue. See the end for an exciting update!

The Weekend Reccs

Meat without Animals: Cultured meat (also called “clean meat”) is one of the many hot new things promising to disrupt the animal husbandry business with a product that will make the world, well, less hot. Cultured meat has been in the mainstream since 2013. In Israel, the world’s first cultured meat restaurant just launched. The biggest issue cultured meat still faces is not just cost, but structure. It is incredibly hard to build a 3D block of tissue, and so right now most of the field is confined to growing 2D sheets of meat and then grinding them together into burgers and pseudo-fillets. Those issues aside, cultured meat presents a possibility for much more energy-efficient meat products. My prediction is that in the future we’ll see a lot of folks transition from being pescatarian or guilty-omnivores into “I only eat cultured meat and insect protein” for sustainability reasons.

Choosing Well: This is a long read, but it instigates some worthwhile reflection. I appreciate how much I have thought about the themes in the article since reading it, but take issue with two key aspects of it.

First, I’d offer a vocabulary from decision science that is more accessible, albeit subtly different than the one they use. Agents (that’s you and me) can face one of three qualities in their environment: risk, uncertainty, or ignorance. These qualities reflect the degree to which the agent’s model (that is, their understanding of the environment) maps to the ambiguities in the environment.

For those that may find this model—environment distinction confusing, imagine that you are playing Monopoly. You agree with all your friends that y’all are following Hasbro’s official rules for the game. You are operating under the model that if you land on “Go” you get and extra $200, since that is the rule your family always followed, and so you thought it was an official rule. Your model of the official rules would not match the actual rule environment, in which no special treatment is given to landing on “Go.” In this case, you’d have an incorrect model of the environment.

Alternatively, you could be on Pennsylvania Avenue and really want to get to Boardwalk. Your model says that you have an 11% chance to roll the 5 needed on your next turn. You roll the dice and you get an 7, placing you on Mediterranean Avenue instead, with Boardwalk elusively out of reach. In this case, your model was perfectly calibrated to your environment by saying that you had an 11% chance of landing on Boardwalk. That you ended up experiencing the other 79% of the probability distribution doesn’t mean that anything was necessarily amiss.

Back to the three states. They are: risk, uncertainty, and ignorance (loosely mapping to “expected uncertainty”, “unexpected uncertainty”, and “volatility” in the linked article).

Risk is when you know the probability but you don’t know the outcome. For example, flipping a fair coin can be described as risk, as you know there is a 50/50 shot of either outcome. Before flipping the coin you don’t know what will happen, but you know 50% of the time it will come up heads.

Uncertainty is when you know the overarching structure of the environment but do not know the probabilities that resolve certain ambiguities. Most of our life can be described under uncertainty. Think about this as trying to guess who will win a soccer game. You don’t actually know the teams’ probabilities for winning the game beforehand, but you know all the rules of the game and you can use relevant data to estimate the probabilities, even if you don’t know the optimal weighting of the data (star player has a sprained ankle = less likely to win, but is it a lot less likely or just a little less likely?). If you’re Nate Silver, you make money by being better at quantifying these weights than other people.

Ignorance is when you don’t know the structure of the environment. An old professor of mine, Richard Zeckhauser, used to use the example of 9/11 here: it felt like the whole world was turned upside down and nobody knew what was important to know or what was going to happen tomorrow. Ignorance does not only appear in high stakes situations, though. Trying to navigate the social dynamics at a new office, for example, is a situation of facing ignorance. You don’t yet know the connections that exist between the other agents in the environment.

Crucially, the application of these three states requires a generally accurate model. In the Monopoly rules example above, the player wasn’t operating under ignorance, they were operating under an inaccurate model. Similarly, thinking that you had a 40% chance of landing on Boardwalk because “it’s your time to get lucky” is not facing ignorance or uncertainty or risk, it is just inaccurate.

While I’d admit that there are perhaps more delineations and refinements to be made to this framework, I vastly prefer it to that used in the article.

Second, I take issue with the assessment of Max Hawkins’ discontent and strategy.

For background: I spent around two years working as a research assistant in computational psychology. The research centered around using algorithmic models to describe human behavior. Much of my work, especially with respect to social cognition and implicit biases, relied on reinforcement learning models (in the AI sense, not the typical psychological sense, to the confusion of everyone) and so I continue to think mostly in those terms.

In my eyes, a much more simple explanation of Hawkins behavior is that we all follow a poorly calibrated exploration—exploitation algorithm in our daily life. We explore until we feel we have a very rudimentary grasp of the environment, then we exploit the best option. Plenty of research has shown that we typically under-explore our spaces writ large, resulting in the “local maxima” discussed in the article. When it comes to the small stuff, though, we try too hard to minimize uncertainty in our environments either through information or management. This pattern leads to burrowing in on the small stuff and rarely making “big” changes in our life, despite probably making the first few “big” decisions with far too little information.

I would argue the issue here was simply that Hawkins under-explored the range of possible preferences. He didn’t need to use a crazy randomization technology to find contentedness, he just needed to build in a little deliberate exploration into what I imagine was an overly-scheduled tech career.

That all being said, I have increasingly come to a radically different view of how one can live a contented life that is fairly divorced from this framework of exploration, exploitation, and optimization.

These past few months, as the Coronavirus pandemic has waged on, I’ve found that more and more people who had previously operated under any sort of utility-maximizing optimization strategy (whether that utility is tied to career prospects, income, freedom, family life, whatever) seem to have found themselves severely discontented with their present outcome.

It seems to me that any such usual framework (and, I should note, as an economics-minded individual, I feel like I am defying the sacrosanct in writing this) is too focused on the outcomes and not the process.

A growing body of evidence suggests mindfulness and “being present” promotes long-term life satisfaction. A lot of the research boils down to an old cliché of focusing on the journey and not the destination. Applying this sort of thinking to decision frameworks is hard, as such frameworks are built almost entirely around the destination. One way I’ve been thinking of as a backdoor for this sort of process-oriented thinking is what I would call identity-based decision making (EDIT: To be more precise let’s call this self-clarifying decision making instead, as it has nothing to do with “identity” as is used in modern rhetoric. See next week’s post for more on this.).

The gist of it is that when you are faced with a decision, the choice you make should be made based on the conception of the person you believe yourself to be at your best.

Have a terrible boss but you’re afraid that quitting will damage your job prospects? Don’t try to game out which makes you happier in the long term. Instead, work towards a clearly defined sense of self. What characteristics define you as a person? Which decision upholds these characteristics?

It may seem short-sighted, and in a way it is. But at the end of the day the framework is only accountable to your conception of yourself. Making decisions that accord with your self, regardless of outcome, is the fullest embodiment of deciding on the journey and not the destination. The outcome may be poor, you may make the “wrong choice” for your career or your finances. But you made the decision that was authentically yours, and thus the outcome doesn’t have normative weight, it is simply what you are going to experience.

You can lose just about everything in this world except for your conception of your self, in whatever form it takes. That’ll be your constant companion, and thus, I believe, a lodestar to contentedness.

Future of Real Estate? Bringing things back down to everyday life: there have been some beautiful innovations for studio apartments and other parts of the real estate market in response to COVID. One thing that I think has possibly been good about COVID is shaking up the so-called “amenities arms race” between apartment buildings. It had seemed to me that in many pricy neighborhoods consumers were losing out by being forced to bundle amenities they didn’t really want with worse apartments. Now, with little reason to push for more expensive amenities, perhaps developers will focus again on apartment quality.

Quick Links:

Some delightfully cute animals of the early 1800s by Keisai Kuwagata

I have become obsessed with Virginia Jaramillo’s art (s/o Aren Rendell)

Shameless plug: RISC was in the news for our work around data literacy

Lagniappe

The article in Choosing Well above quotes one of my favorite books of all time, The Hitchhiker’s Guide to the Galaxy by Douglas Adams. Unless you absolutely hate science fiction it is a must-read. It is really more of a comedy book than a science fiction book. I think that to this day it is the only book that has made me actually laugh out loud (on several occasions), even upon re-reading it.

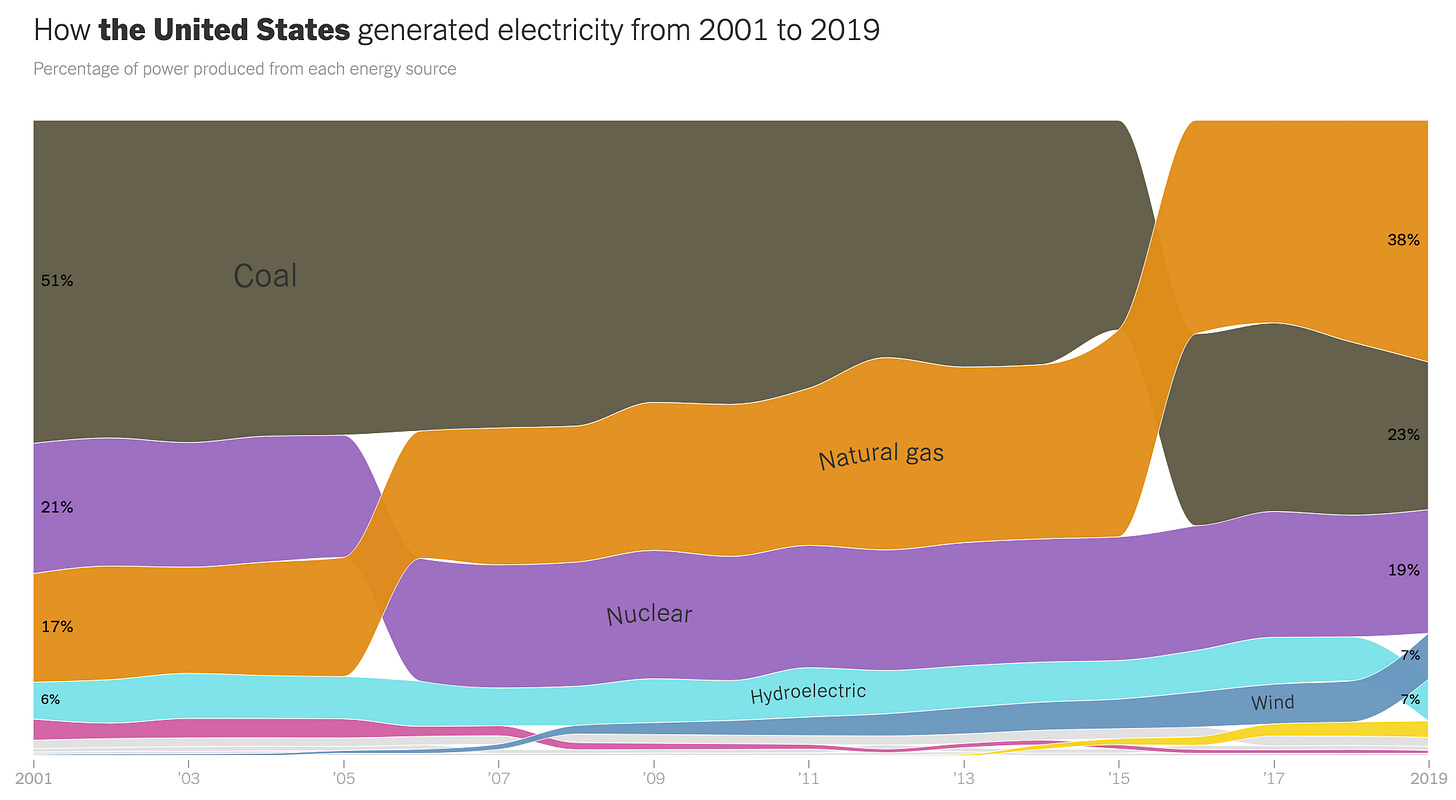

Graph(s) of the week

[NYT] State-by-state graphs in this article. I haven’t had a chance to dig too deeply into it but this may be an area where we will see a growing schism in policymaking incentives among different regions.

[WSJ] I have been thinking a lot about these sorts of graphs, and how much of it is true belief and how much of it is partisan posturing. It seems hard for me to imagine that either party feels that a split Congress with a different executive would actually have that large an impact on the fundamentals of the economy. Even if you think there’ll be a shakeup at the Fed, Jay Powell is probably as close to a replacement-level Biden nominee as one can possibly imagine.

I’ve been imagining some alternative measures here, potentially looking at propensity to save (operating under the assumption that one saves more when they believe the economic outlook is grim). I wonder if someone I know with access to JPMorgan Chase data might have some insights here (cough cough).

This week the Weekend Reccs passed 100 subscribers! A very big and very heartfelt thank you to everyone who has shared this newsletter with their friends, family, and colleagues. It really has taken me by surprise how many folks have enjoyed it and passed it on, and I certainly never expected my small email chain to have grown this much (nor this rapidly). I have so enjoyed spending these last few months (virtually) with all y’all.

To celebrate this milestone, it would mean a lot to me if you’d each share this issue with someone new. You can do so either by forwarding this email or clicking the “Share” button at the bottom of this post.

With plenty of thanks, and lots of recommendations,

Harrison